Introduction

When it comes to borrowing money, there are plenty of options to choose from. However, not all lending services are created equal. Take a closer look at LendYou.com Review, one of the most popular lending services on the market, and evaluate its features, benefits, and drawbacks.

What is LendYou?

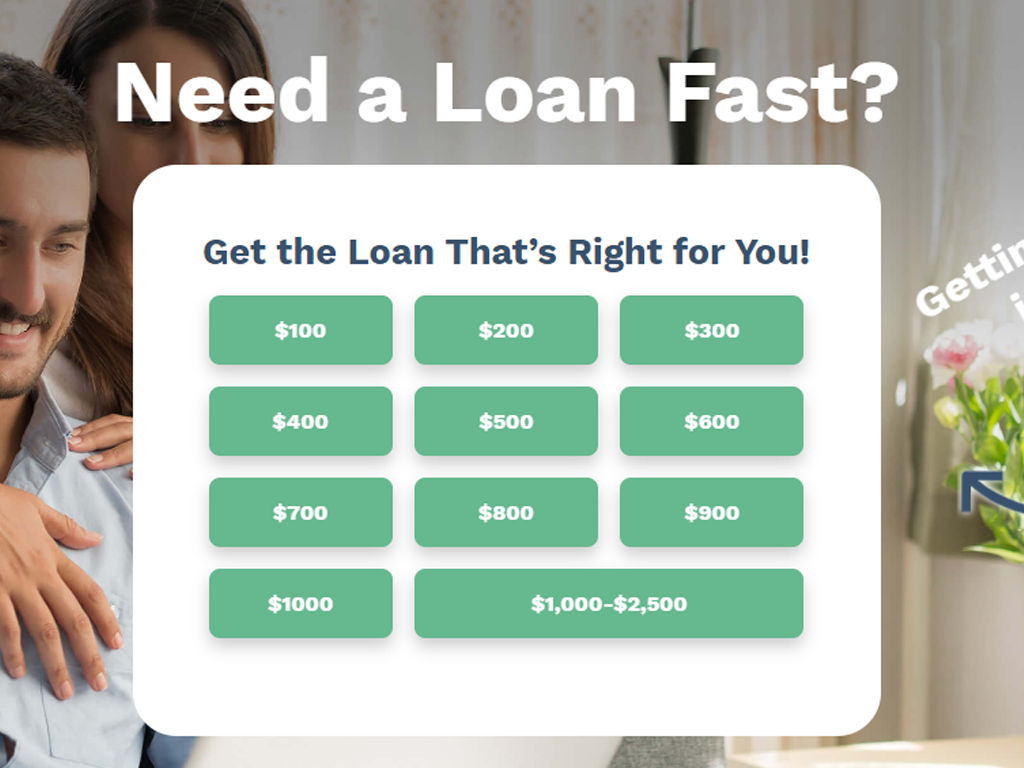

It is an online lending platform that connects borrowers with lenders. The service allows borrowers to apply for loans ranging from $100 to $35,000, with a repayment term of up to 60 months. It is not a direct lender but works with a network of lenders to provide borrowers with access to a variety of loan options.

How does LendYou work?

To apply for a loan, borrowers need to complete an online application form, which takes only a few minutes. The application requires some basic personal and financial information, such as name, address, income, and employment status. Once the application is submitted, LendYou matches the borrower with a suitable lender based on the borrower’s credit score, income, and other factors.

LendYou Loan Features

One of the significant advantages of using it is the wide range of loan options available. Borrowers can apply for loans for various purposes, including personal loans, payday loans, and installment loans. LendYou also offers competitive interest rates and flexible repayment terms, making it an ideal choice for borrowers with different financial needs.

Ioffers several benefits to borrowers, including:

- Easy and quick online application process

- Access to a wide range of loan options

- Competitive interest rates and flexible repayment terms

- No hidden fees or charges

- Fast funding options

While it has many benefits, there are some drawbacks to using the service, including:

- Not all borrowers will qualify for a loan

- Some lenders may charge high-interest rates

- LendYou is not a direct lender, and borrowers have limited control over the loan terms

- Some lenders may require collateral, such as a car or property, for certain types of loans

Maximum Loan Amounts

Now, let’s break down the maximum loan amounts that you can access through LendYou across different loan types:

1. Installment Loans

- Maximum Amount: Up to $5,000

2. Payday Loans

- Amount Range: $100 to $1,000

3. Personal Loans

- Maximum Amount: Up to $35,000

In conclusion, it’s pricing model is straightforward and offers free access to their platform while making money via lender commissions.

Comparing

It’s critical to assess it’s advantages and disadvantages in comparison to other loan options to see if it meets your unique needs. Let’s examine some popular lending options to LendYou and see how they compare:

- Personal loans from banks or credit unions: These loans typically offer lower interest rates than LendYou, but the application process is more stringent, and it may take longer to receive funding.

- Payday loans: Payday loans are a fast and convenient way to borrow money, but they come with high-interest rates and short repayment terms. LendYou offers more flexible repayment terms and lower interest rates for similar loans.

- Online lenders: Like LendYou, many online lenders offer fast and easy application processes and flexible loan options. However, some online lenders may charge high-interest rates or have hidden fees and charges.

Conclusion

Overall, it is an excellent option for borrowers looking for a quick and easy way to access loans with competitive interest rates and flexible repayment terms. While there are some drawbacks to using the service, the benefits outweigh them, making it a top choice for borrowers with different financial needs. If you are looking for a loan, please click the button below.